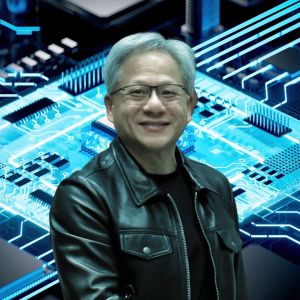

Nvidia still carries the stock-boosting power, but its strength may be waning as some investors wonder how long it will last. According to a recent Bloomberg report, Nvidia founder Jensen Huang’s praise of Samsung Electronics memory chip capabilities last Wednesday prompted a 3% jump in the company’s shares. MediaTek stocks also rose to an all-time high following its unveiling of a partnership with the company at the CES trade show, where Huang gave the keynote address; however, both stocks have been down about 6% since then. Moreover, the company’s shares have dropped 12%. Business experts say geopolitical tensions, trade policies, and rising competition for investor attention are weighing on the sector and the company’s stock. Nvidia stocks skyrocketed last year as AI chips were new Source: Bloomberg Jung In Yun, CEO of Fibonacci Asset Management Global, said that this time around, there’s a chance Jensen Huang’s comments won’t carry the same weight as they did last year. He added, “Nvidia’s position is still dominant, but rivals are also rising, and we should increasingly focus on what non-Nvidia players are saying.” Tech stock declines also recently came from concerns around Federal Reserve rate cut delays and U.S. AI chip export restrictions. Donald Trump and his influential friend, Elon Musk, are two individuals who could dramatically change the sector, and the market will be keenly watching their policy plans. When AI chips were new last year, Nvidia was a stronger force, and “its stock skyrocketed,” said Ahn Hyunsang, CEO of Korea Investment Research Institute. He added, “ This year, Trump and Musk are expected to have a much bigger influence.” However, the excitement around Nvidia isn’t cooling, as its stock reached an all-time high just last week. It can still inspire other companies’ shares to surge. From Zero to Web3 Pro: Your 90-Day Career Launch Plan