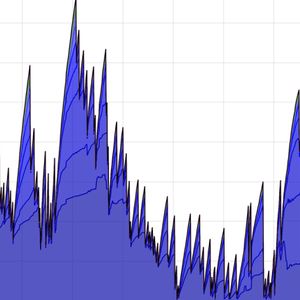

Toncoin (TON) has faced a prolonged downturn, struggling to regain upward momentum after a tough week. Although it recently recorded a slight daily gain, the asset remains trapped in bearish territory, trading below the $4 mark. Despite this challenging price performance, analysts suggest that Toncoin may be nearing a significant accumulation phase. Related Reading: New Data Suggests Toncoin (TON) Might Be Undervalued—Here’s What It Means Key Metrics Indicate Potential Recovery Amid these market conditions, a CryptoQuant contributor, Crazzyblockk, recently shared a detailed outlook on TON. In a post titled “TON Enters Key Buy Zone – A Prime Opportunity,” the analyst outlined key findings from the Ton Price Models. These models indicate that Toncoin has reached the 0.6x 250-day moving average bottom zone—historically considered a strong accumulation level. Crazzyblockk notes that this data-driven model suggests TON is undervalued, presenting a potential buying opportunity for long-term investors. Notably, the Ton Price Models leverage historical data to identify oversold conditions and potential entry points. According to Crazzyblockk, assets trading near 0.6x–0.8x of their 250-day moving average often signal strong buy conditions. Historically, these levels have served as ideal accumulation zones before major market upturns. The analyst emphasized that TON’s current price position aligns with previous setups that have led to significant price recoveries, making it a promising target for data-driven investment strategies. Toncoin Price Performance And Outlook Meanwhile, Toncoin’s price on the higher time frame has continued to demonstrate a bearish move. In the past two weeks alone, this metric has fallen by a double-digit of 23.4% and roughly a 54.3% decrease away from its all-time high of $8.25 registered in June 2024. However zooming in, TON has shown resilience recording a slight increase of 2.8% in the past day. This uptick although little has been able to push TON’s price above $3.8 nearing the $4 mark. Interestingly, while TON’s price has risen today, its daily trading volume is notably lower compared to last Friday, when the asset was trading at a similar price level. Last Friday, TON’s trading volume exceeded $214 million. However, as of today, it has decreased to $161.2 million. One possible explanation for this drop in trading volume could be a shift in investor behavior, with some market participants holding their positions rather than actively trading, potentially in anticipation of continued price appreciation. Speaking of price appreciation, a renowned crypto analyst known as Ali on X has recently shared an interesting analysis on Toncoin using the TD Sequential indicator. Related Reading: Is Toncoin Set for a Comeback? Key Market Signals Point to a Possible Rebound This indicator is a tool that helps identify potential trend reversals and exhaustion points in price movements. It works by counting a series of consecutive price bars that close higher (in an uptrend) or lower (in a downtrend) than previous bars, forming a sequential count. Once the count reaches a certain number—often 9 or 13—the indicator suggests that the prevailing trend may be losing momentum and could reverse or pause. According to Ali, TON is on the verge of a rebound based on this tool. #Toncoin $TON is showing signs of a potential rebound as the TD Sequential indicator flashes a buy signal on the weekly chart! pic.twitter.com/nRtabmxjxQ — Ali (@ali_charts) February 14, 2025 Featured image created with DALL-E, Chart from TradingView