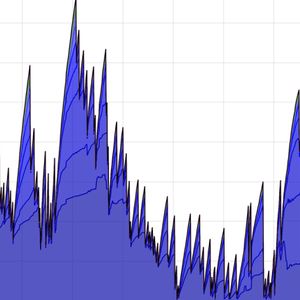

After dropping below $100,000 earlier this month, Bitcoin has faced sluggish price movement with little upward momentum. Over the past week, the asset has just ranged below this six-digit mark with its price now hovering above $96,000 as of today. This sideways movement reflects a lack of significant momentum and has left many traders questioning what might spark the next major move. Related Reading: Bitcoin’s Bull Cycle: Analyst Says The Upside Isn’t Over Yet Late Longs Liquidated: The Impact Despite the lack of a breakthrough, Bitcoin’s price behavior continues to attract the attention of market analysts. One such expert is Amr Taha, a contributor to CryptoQuant’s QuickTake platform. Taha’s recent analysis in a post titled: “Late Buyer’s Liquidation Events Happened 3 Times Under 98K,” sheds light on a notable pattern of liquidations among long positions. His insights offer a deeper understanding of how market dynamics can shift following these liquidation events. Taha describes “late longs” as traders who enter the market after a substantial price increase, often motivated by fear of missing out (FOMO). These positions tend to be highly leveraged, making them more vulnerable to even minor price corrections. According to Taha, late longs often emerge near local price peaks, and their presence can destabilize the market. The analyst points out that when these positions are liquidated, it serves a dual purpose. Firstly, it reduces the market’s open interest, helping to flush out excess leverage and restore a more balanced trading environment. Secondly, these liquidation events can present opportunities for experienced traders. By stepping in after forced selling, savvy market participants can potentially secure better entry points and position themselves for the next upward price movement. Bitcoin Market Performance Bitcoin has seen quite a bullish performance in the past day increasing by 1.3% in price to currently trade at $96,725, at the time of writing. However, on a broader scale, the asset still appears to be somewhat bearish with its weekly and monthly price performance in red. Interestingly, despite the uptick in BTC’s price today, its daily trading volume as of today remains lower than that of last week. Last Friday, BTC’s daily trading volume stood above $50 billion however, as of today this metric has dropped to $24.7 billion. Related Reading: Bitcoin’s Realized Cap Hits Record High—Is a Major Bull Run Brewing? Meanwhile, a crypto analyst known as Javon Marks has revealed that based on some bullish indicators emerging on BTC’s price chart, a “bullish result” is imminent. Bull-Flag Breakout HOLDING 🏁! Bullish Results looking imminent, on multiple metrics.$BTC pic.twitter.com/9IRnzX71P8 — JAVON⚡️MARKS (@JavonTM1) February 14, 2025 Featured image created with DALL-E, Chart from TradingView