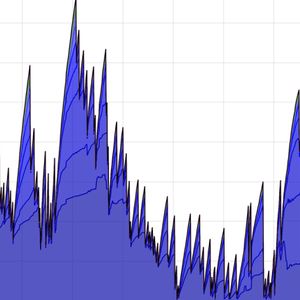

Ethereum users, rejoice! Are you tired of those exorbitant gas fees eating into your crypto profits? Well, there’s fantastic news in the Ethereum ecosystem. This week, we’ve witnessed a dramatic and welcome change: Ethereum fees have plummeted by over 70%! This significant drop, reported by IntoTheBlock on X, is a direct result of a recent gas limit increase on the network. Let’s dive into what this means for you, the average Ethereum user, and the broader implications for the Ethereum network. Why are Ethereum Transaction Costs Dropping? The Gas Limit Explained To understand why your Ethereum transaction costs are suddenly much lower, we need to talk about the gas limit. Think of the Ethereum network as a bustling highway, and each transaction as a car trying to get through. The ‘gas limit’ is essentially the capacity of this highway – it dictates how many transactions can be processed in each block. Recently, Ethereum developers increased this gas limit. What does this mean in simple terms? Increased Capacity: A higher gas limit means the Ethereum highway can handle more ‘cars’ (transactions) at once. Reduced Congestion: With more space available, the traffic jam of pending transactions eases up. Lower Fees: Less congestion translates directly to lower gas fees. When the network is less crowded, you don’t have to bid as high to get your transaction processed quickly. Imagine it like this: during rush hour, ride-sharing services surge their prices due to high demand. Increasing the gas limit is like adding more lanes to the highway – reducing the ‘rush hour’ effect and bringing prices ( ETH gas price ) back down to earth. The Immediate Benefits of Lower Ethereum Fees This fee reduction isn’t just a number on a chart; it has tangible benefits for everyone interacting with the Ethereum network . Let’s explore some of the key advantages: Affordable Transactions for Everyone: Small transactions, like sending ETH to a friend or buying a low-cost NFT, become significantly more viable. Previously, high gas fees could make these activities prohibitively expensive, especially for smaller amounts. Boost for DeFi Participation: Decentralized Finance (DeFi) protocols on Ethereum often involve multiple transactions. Lower fees make participating in yield farming, swapping tokens, and other DeFi activities much more attractive and profitable. NFT Marketplaces Thrive: Buying, selling, and trading NFTs becomes cheaper. This can revitalize NFT marketplaces and encourage broader participation, especially for new entrants who might have been deterred by high gas costs. Increased Dapp Usage: Decentralized applications (Dapps) built on Ethereum become more accessible. Users are more likely to interact with Dapps if they aren’t burdened by hefty transaction fees each time. Is This Fee Reduction Sustainable? Challenges and Considerations While this 70% drop in Ethereum fees is undoubtedly positive, it’s crucial to consider whether this is a long-term solution and what potential challenges might lie ahead. Demand Fluctuations: The Ethereum network is dynamic. If demand for transactions surges again, even with an increased gas limit, we could see fees rise once more. Network activity is influenced by market trends, new project launches, and overall crypto adoption. Long-Term Scaling Solutions: Increasing the gas limit is a helpful adjustment, but it’s not a fundamental scaling solution. Ethereum’s long-term roadmap includes Layer-2 scaling solutions (like rollups) and the ongoing transition to Ethereum 2.0, which are designed to address scalability more comprehensively. Centralization Concerns: Some argue that continually increasing the gas limit might favor more powerful validators and potentially lead to centralization over time. This is a complex technical discussion within the Ethereum community. Network Security: While not directly related to the gas limit increase itself, any changes to the network must be carefully considered in terms of security implications. Maintaining robust security remains paramount for Ethereum’s long-term success. Actionable Insights: What Should Ethereum Users Do Now? So, what does this mean for you as an Ethereum user? Here are some actionable insights: Explore DeFi Opportunities: With lower ETH gas price , now might be a great time to explore DeFi platforms and strategies that were previously too expensive due to transaction costs. Engage with NFTs: If you’ve been on the sidelines of the NFT market due to gas fees, consider browsing marketplaces and participating in NFT projects that interest you. Use Ethereum Dapps More Freely: Experiment with various Ethereum-based decentralized applications without worrying as much about each interaction costing a fortune in gas. Stay Informed: Keep up-to-date with Ethereum network developments and scaling solutions. The crypto space is constantly evolving, and understanding these changes will help you navigate it effectively. A Breath of Fresh Air for the Ethereum Network The significant drop in Ethereum fees following the gas limit increase is undoubtedly a breath of fresh air for the entire ecosystem. It makes the network more accessible, affordable, and user-friendly. While it’s not a silver bullet solution to all scalability challenges, it’s a positive step in the right direction. This development can spur greater adoption, innovation, and activity within the Ethereum ecosystem, paving the way for a more inclusive and vibrant future for decentralized technologies. The relief felt by Ethereum users is palpable, and the hope is that this trend towards lower fees continues as Ethereum evolves and scales. To learn more about the latest Ethereum trends, explore our article on key developments shaping Ethereum price action.