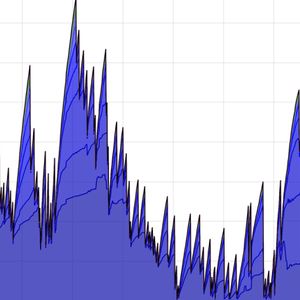

A single endorsement from Argentina’s president, Javier Milei, made the Libra token the highlight of the crypto market, but the price soon plummeted 90%. Interestingly, a series of events changed this crypto token from trending to a scam after the insiders entered the market, cashing out $107M. This resulted in the collapse of Argentina coin, leaving investors with massive losses. Let’s discuss. LIBRA Token Price Meteoric Rise and Sudden 90% Fall LIBRA was introduced as part of the Viva La Libertad Project, which aims to stimulate Argentina’s economy by funding smaller businesses and startups. Also, Argentina’s president, Milei, publicly endorsed this coin and urged global investors to participate. This private project will be dedicated to encouraging the growth of the Argentine economy by funding small Argentine businesses and startups, says Milei Interestingly, Javier Milei’s endorsement pumped the LIBRA token price by 3000% to an ATH of $4.5. Moreover, within hours of launch, it attained a fully diluted valuation of $4.5 billion. Similar mania, such as the TRUMP and MELANIA meme coins, formed around this token and gained global attention. However, like MELANIA and TRUMP’s price crash , LIBRA crashed by 90%. This crash began with the on-chain analytics revealing that insiders or a few whales control 82% of the LIBRA coin supply. Moreover, the LIBRA team pulled $87 million in USDC and SOL from liquidity and crashed the coin price. However, that was not all, as insiders soon entered the picture and cashed out $107 million. Although they made $20 million in profits, the remaining holders bore heavy losses. At present, LIBRA coin trades at $0.2236 after a 90% drop from its prime per Dexscreener. Also, it has a market capitalization and trading volume of $221.3M and $1.13B significantly. This incident has shaped investors’ sentiments around trending cryptos. Argentina’s President’s U-Turn and Political Fallout President Milei has taken a U-turn from his endorsement after this controversy. In an X post, Milei claimed he was unaware of LIBRA’s inner workings before admitting his failure to do due diligence and has deleted his earlier tweet. More importantly, Milei lashed out at his political opponents, indirectly claiming that they manipulated him and pushed him into the scandal. To the filthy rats of the political caste who want to take advantage of this situation to harm, I want to say that every day they confirm how vile politicians are, and they increase our conviction to kick them in the ass. However, this is not the first Milei controversy. In 2021, he was caught in a similar situation. He endorsed an alleged Ponzi scheme, CoinX, which promised multiple-fold returns with AI-assisted trading. At that time, investors lost millions, and victims filed lawsuits against Milei. Now, investors have also lost millions of dollars due to this LIBRA token price crash. Experts claim that almost 100% of non-insiders have lost money on this crypto project. One trader faced a $2 million loss within two hours after spending $2.85M to buy 1.11M LIBRA. However, the LIBRA coin crash reduced its worth to just $781,000. Is LIBRA Token Price Crash Another Pump-and-Dump? This incident has sparked serious discussion amid this crypto community, where some have commented that they never trust the president-figure endorsement. Investors’ mindset is turning this way because, before this, the Central African Republic’s CAR token crashed despite reaching a billion valuation. Additionally, US President Donald Trump’s TRUMP meme coin struggles present another volatile project, leading to investors’ concerns over such a launch. Although Milei has turned his back on the project, experts believe his endorsement has violated Article 265 of Argentina’s Penal Code. As a result, Milei may be affected legally, as it would be considered market manipulation and the allegedly pump-and-dump scam. Bottom Line The meteoric rise and sudden fall of the LIBRA token price are testaments to the dangers of speculative crypto projects. Moreover, endorsement and support from big profiles could impact investors seriously. More than the crash, Argentina’s president’s involvement has turned this situation more serious, as it brought global investors’ attention to the LIBRA coin. However, this is not the only incident. Other controversial claims revolve around TRUMP, CAR, and Dave Portnoy’s JAILSTOOL crypto coins. Investors must be cautious when trading in the crypto industry, as trends could become disasters. The post Argentina’s LIBRA Token Price Crashes 90% As Insiders Cash Out $107M appeared first on CoinGape .