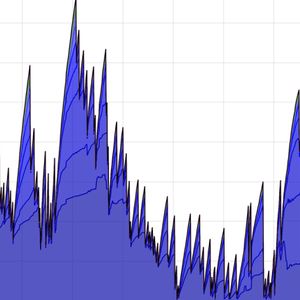

As XRP targets reclaiming the $3 spot, the asset’s current trading pattern resembles a historical movement that points to a potential upside of about 350%. Specifically, XRP appears to follow a pattern that echoes its historic 2017 rally, which saw the cryptocurrency skyrocket by over 1,300% in multiple phases. Now, if this pattern plays out, it could set the stage for an even larger breakout, potentially pushing XRP’s price to $12.50 in 2025, according to an analysis by TradingShot shared in a TradingView post on February 14. XRP price analysis chart. Source: TradingView According to the analysis, XRP’s rise in 2017 played out in three rallies, each delivering four-digit percentage gains. After surging 600% since November 2024, the token may be gearing up for its next major move, targeting a double-digit figure. At the same time, this bullish projection is backed by key technical indicators . TradingShot’s analysis indicated that the 50-day moving average ( MA ) has crossed above the 200-day MA, which acts as a strong bullish signal, suggesting XRP could mirror its 2017 bull run. The expert noted that XRP could see a 1,300% surge if history repeats, pushing its price to $12.50. If this target is achieved, XRP’s market cap will rise to $722 billion, potentially making it the second-largest cryptocurrency if Ethereum ( ETH ) stagnates. However, insights from Finbold’s artificial intelligence (AI) tool present a more conservative outlook for XRP in 2025. The tool, leveraging several models, set an average XRP price prediction at $3.065, an upside of 9.29%. Among the tools, Claude 3.5 Sonnet projected XRP will hit $3.85, a 37.99% growth, while OpenAI’s ChatGPT-4o set a price of $2.80. On the other hand, ChatGPT-4o Mini forecasted a significant drop in XRP’s price by 10.39% to $2.50. Finbold AI XRP price prediction. Source: Finbold Why XRP is surging XRP is gaining in the short term after new developments regarding the asset’s related spot exchange-traded fund ( ETF ) emerged. On February 14, the Securities and Exchange Commission ( SEC ) acknowledged the 21Shares application, which opens the door for a review process toward possible approval. Given the new cryptocurrency-friendly administration, there remains optimism that the product will get a nod. Meanwhile, XRP could see further upside if the SEC moves to end the case against Ripple . The XRP community anticipates that with the new administration, the SEC will be able to drop the case or reach a settlement favorable to the blockchain firm. As things stand, XRP is targeting $3, which is the main resistance level to watch. To this end, prominent cryptocurrency analyst Ali Martinez, in an X post on February 14, stated that XRP shows signs of a strong recovery, bouncing from the lower boundary of its ascending channel and now appearing poised for a potential rally toward the $3 mark. XRP price analysis chart. Source: TradingView/Ali_charts The analysis noted that XRP remains within a clear ascending channel, finding support at $2.40 and resistance at $2.80 and $3.00. Therefore, a breakout above the midline of this channel could further fuel bullish sentiment, with an ultimate target near the upper boundary at approximately $3.60. XRP price analysis By press time, XRP was trading at $2.78, surging over 6% in the last 24 hours. In the past week, the token has been up almost 16%. XRP seven-day price chart. Source: Finbold In the short term, the overall XRP sentiment remains bullish. The asset is comfortably trading above its 50-day simple moving average (SMA) of $2.62 and 200-day SMA ($1.36), indicating a strong uptrend. With a relative strength index ( RSI ) of 54.81, XRP’s momentum remains neutral, showing no immediate overbought or oversold signals. On the other hand, the market seems to be indecisive, given that the Fear & Greed Index stands at 50. Featured image via Shutterstock The post Expert sets XRP’s price path to $12.50 appeared first on Finbold .