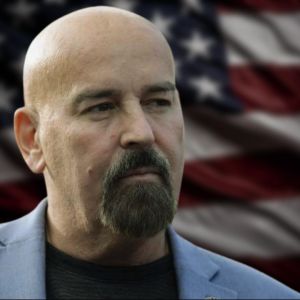

XRP lawyer John Deaton has accused the US Securities and Exchange Commission (SEC) of targeting legitimate crypto companies while ignoring actual fraudsters like Sam Bankman-Fried (SBF) and Do Kwon in a post on X today. “The SEC missed actual fraud being committed in crypto because it had a bureaucratic hack in Gary Gensler hyper focused on implementing a political agenda set by his master Sen. Elizabeth Warren. Let’s not forget Gensler met with the Bernie Madoff of crypto – SBF – multiple times,” Deaton wrote . “SBF met with Rep. Maxine Waters, former CFTC Chair Rostin Benham, and was allowed to testify before Congress. Why was he given such incredible access? Simple! He paid for it.” According to testimony from SBF’s own trial, he funneled $10 million to the Biden Administration and $70 million to Democrats during the 2022 midterms, allegedly to gain access to regulators. The SEC took years to go after Kwon, despite clear signs of fraudulent activity in Terra’s operations. When the SEC finally subpoenaed him at a crypto conference, it was met with public mockery and outrage, with Gensler’s face even being edited onto Darth Vader’s body in memes. Amanda Fischer, Chief of Staff at the SEC, defended the agency’s handling of Kwon, admitting the SEC could have been more aggressive but blaming Kwon’s legal maneuvers for delaying action. “The SEC should’ve sued him over many things, not just one,” Fischer said. “But it’s hard to do when the defendant fights the legality of the subpoena and drags out discovery over years.” She then criticized the crypto community, asking why many rallied to Kwon’s defense instead of pushing for stricter enforcement. “What introspection do you have about the industry rallying to Kwon’s defense?” she asked. Federal courts rip apart SEC’s enforcement strategy The SEC’s aggressive crackdown on crypto firms led to multiple legal defeats. Judges have accused the SEC of acting unlawfully in its enforcement approach. Deaton pointed to a ruling where a federal judge said SEC lawyers had ‘lacked faithful allegiance to the law.’ An appellate court later found the SEC had acted ‘arbitrarily and capriciously’, while a third judge went so far as to sanction the SEC for lying to the court. One of the most controversial SEC actions under Gensler was the lawsuit against Coinbase. The SEC had approved Coinbase’s IPO in 2021, saying it was in the public’s best interest. Less than two years later, the agency turned around and sued Coinbase, claiming its entire business model was illegal. But now, the SEC is reportedly dropping the lawsuit against Coinbase. Coinbase CEO Brian Armstrong confirmed on X that a deal has been reached with the SEC’s staff to dismiss the case, though it has not been officially announced by the agency itself. Brian called the decision a huge win and thanked crypto voters for helping elect pro-crypto politicians. “The crypto voter is real and showed up in the millions,” he wrote. The SEC had originally accused Coinbase of operating an illegal exchange, broker, and clearing agency while offering unregistered securities. The lawsuit was part of a broader crackdown that Trump promised to reverse during his campaign. Trump’s new SEC scraps the old crypto enforcement playbook Under Trump’s administration, the SEC is taking a new approach. The agency just announced the creation of the Cyber and Emerging Technologies Unit (CETU) to replace the Crypto Assets and Cyber Unit. CETU, led by Laura D’Allaird, consists of 30 fraud specialists and attorneys focused on cybercrime and financial misconduct. Acting SEC Chairman Mark Uyeda said CETU’s goal is to protect investors while allowing crypto innovation to grow, adding that, “This new unit will complement the work of the Crypto Task Force led by Commissioner Hester Peirce.” The CETU will prioritize fraud cases that have to do with AI, the blockchain, and social media. It will also go after hackers who steal insider information on social media, or fake trading websites and retail brokerage account takeovers. Trump’s campaign explicitly targeted the SEC’s aggressive crackdown on crypto. During his rallies, he repeatedly promised to fire Gary Gensler on ‘day one’ of his presidency. Gensler resigned himself before Trump could. Cryptopolitan Academy: FREE Web3 Resume Cheat Sheet - Download Now